Did you know your home insulation qualifies for a tax credit?

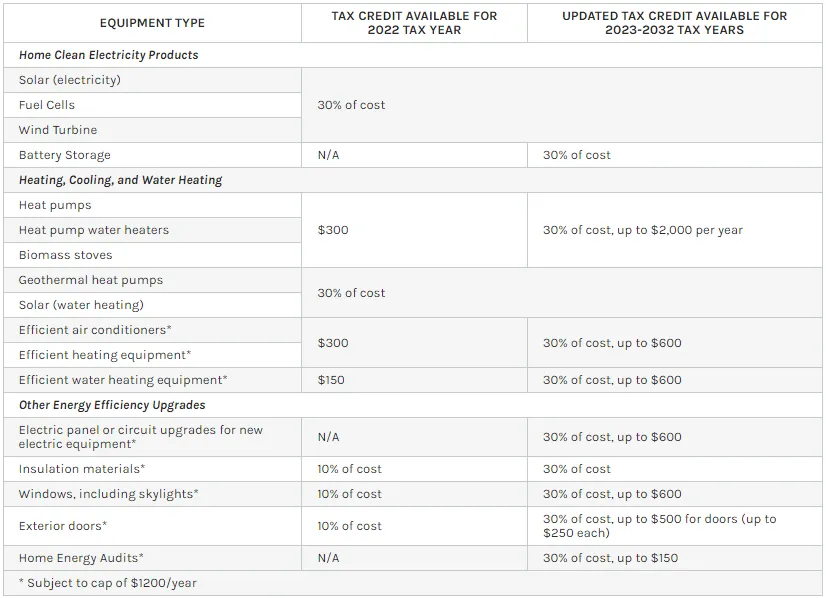

2023 Tax Credit Incentives

Energy Efficiency Upgrades:

Electric panel or circuit upgrades for new electric equipment*: 30% of cost, up to $600

Insulation materials*: 30% of cost, up to $1,200

Windows, including skylights*: 30% of cost, up to $600

Exterior Doors*: 30% of cost, up to $500 for doors (up to $250 each)

Home Energy Audits*: 30% of cost, up to $150

*Subject to cap of $1,200/year

To access all material and services covered through the Clean Energy Tax Credit, click here.

Required Documents & Helpful Resources

Information you need to have filled out for signing:

• Copy of Mincin Insulation contract/invoice

Helpful Resources:

• IRS.gov

• Residential Energy Tax Credits: Changes in 2023

• Federal Income Tax Credits and Incentives for Energy Efficiency

Please note: Insulation work performed before 2023, may only qualify for up to 10% or $500 in tax credits. You should consult a tax expert for any questions regarding your tax services.

Federal Insulation Credit FAQ